Image depicts Archer’s development plans for Hawthorne Airport.

- Signed definitive agreements to acquire control of one-of-a-kind aviation asset in LA, Hawthorne Airport, for $126M* in cash. The airport is located in the heart of the City, less than three miles from LAX, and the closest airport to some of the city’s biggest destinations — SoFi Stadium, The Forum, Intuit Dome, and Downtown LA.

- Archer plans for the airport to serve as its operational hub for its planned LA air taxi network and, as a test bed for the AI-powered aviation technologies it is developing and plans to deploy with its airline and technology partners. United Airlines’ Chief Financial Officer, Michael Leskinen, remarked, “Archer’s trajectory validates our conviction that eVTOLs are part of the next generation of air traffic technology that will fundamentally reshape aviation.Their vision for an AI-enabled operations platform isn't just about eVTOLs, it's also about leveraging cutting-edge technology to better enable moving people safely and efficiently in our most congested airspaces. Through United’s investment arm, United Airlines Ventures, we're investing in companies like Archer that pioneer technologies that will define and support aviation infrastructure for decades to come.”

- Raised $650M of new equity capital, reinforcing Archer’s sector-leading balance sheet taking its total liquidity to now over $2B.

- Showcased several key performance milestones with its Midnight aircraft– including flights surpassing 50 miles in range and 10,000 feet of altitude.

- Closed acquisition of Lilium patent portfolio, expanding Archer’s global portfolio to over 1,000 assets, giving it one of the most robust portfolios in the industry.

- Deployed aircraft in the UAE for test and demonstration flights and strengthened its international reach through marquee partnership announcements with Korean Air, as well as Japan Airlines’ and Sumitomo’s joint venture, Soracle, in Tokyo & Osaka.

LOS ANGELES, CA, November 6, 2025 - Archer Aviation Inc. (“Archer” or the “Company”) (NYSE: ACHR) today announced operating and financial results for the third quarter ended September 30, 2025. The Company issued a shareholder letter discussing those results, as well as its fourth quarter 2025 estimates.

Commenting on third quarter 2025 results, Adam Goldstein, Archer’s founder and CEO said: “The era of advanced aviation has arrived—not as a distant vision, but as a tangible reality. At Archer, we are not waiting for the future; we are building it. The time to seize this transformative opportunity is now.”

Live Webcast Details

Archer will host a live webcast to discuss its results at 2:00 p.m. Pacific Time today. The live webcast and replay is accessible via Archer’s investor relations website at investors.archer.com or conference call by dialing 646-844- 6383 (domestic) or +1 833-470-1428 (international) and entering the access code 726657.

Moelis & Company LLC acted as lead placement agent and Cantor Fitzgerald & Co. acted as joint placement agent to Archer on today’s capital raise. Moelis & Company LLC also acted as financial advisor on the Hawthorne Airport acquisition transaction.

Recent Highlights

Acquisition Of Hawthorne Airport As Strategic Hub for Archer’s Planned LA Air Taxi Network and Testbed For AI-Powered Technologies Under Development

Archer has signed a series of definitive agreements to acquire control of a one-of-a-kind Los Angeles asset, Hawthorne Airport for $126M* in cash. The airport is located in the heart of L.A., sits on an 80-acre site and includes approximately 190,000 square feet of terminal, office and hangar facilities. The historic Hawthorne Airport was built in the 1920s and once helped shape Southern California's aerospace legacy and is also known as Jack Northrop Field. It is strategically located less than three miles from LAX, and is the closest airport to some of the city’s biggest attractions — SoFi Stadium, The Forum, Intuit Dome, and Downtown L.A.

Archer plans for the airport to serve as its operational hub for its planned L.A. air taxi network operations, including serving a key role in the LA28 Olympics Games. Archer also plans to utilize the airport as an innovation testbed for the next-generation AI-powered aviation technologies that it is developing and planning to deploy with its airline and technology partners. This includes AI-powered air traffic and ground operations management, in addition to other key technologies.

Raised $650 Million of Additional Equity Capital

Archer raised $650 million of additional equity capital, taking its total liquidity to over $2B and reinforcing Archer’s sector-leading balance sheet.

Expanded Midnight’s Piloted Flight Envelope with Record Milestones

Archer continued advancing Midnight’s flight test program, completing its longest piloted flight to date, a 55-mile flight lasting 31 minutes at speeds exceeding 126 mph, and its highest altitude flight, reaching 10,000 feet. Additionally, Midnight flew demonstration flights on both days of the California International Airshow allowing tens of thousands of spectators to experience how quiet the aircraft is in flight. This flight testing progress underscores Midnight’s continued path towards performance maturity.

Acquired Lilium Patent Portfolio, Expanding Global IP Leadership

Archer has now closed its acquisition of Lilium’s portfolio of approximately 300 advanced air mobility patent assets for €18M following a competitive bid process. This portfolio gives Archer access to key next-generation technology in ducted fans, high-voltage systems, flight controls, electric engines, and propellers. Following this acquisition Archer’s patent portfolio is now over 1,000 global assets and one of the strongest portfolios in the sector.

UAE Commercial Deployment Underway; Expanding Global Footprint with Key APAC Carriers

Archer commenced Midnight test and demonstration flights in Abu Dhabi this summer and has now begun to receive payments for its ongoing Launch Edition program activities in the UAE. The company continues to make progress through the UAE’s regulatory pathway toward in-country certification of Midnight to unlock commercial passenger-carrying flights. Archer also strengthened its global commercial pipeline with leading air carriers in both Korea and Japan. In Korea, Archer was selected as Korean Air’s exclusive air taxi partner** in the country. In Japan, Archer’s Midnight aircraft was chosen to participate in planned projects in both Osaka and Tokyo through Archer’s partnership** with Japan Airlines and Sumitomo’s joint venture, Soracle.

*Acquisition price includes the acquisition of the master lease of the Hawthorne Airport, as well as certain subleases held by the seller parties with tenants at the airport. The acquisition price does not include Archer’s rights to purchase a controlling stake in the fixed base operator at the airport, develop additional hangar space at the airport, the potential performance-based earnout to certain seller parties or certain bank debt to be assumed as part of the acquisition. For more information, see “Management’s Discussion and Analysis - Recent Developments” in Archer’s Form 10-Q filed on November 6, 2025. The acquisition remains subject to the satisfaction of certain agreed-upon closing conditions.

**Agreements remain conditional, subject to the execution of further definitive agreements with each party and the satisfaction of certain conditions.

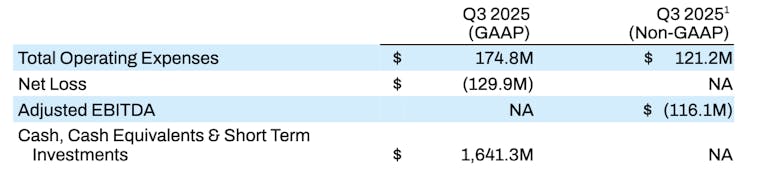

Third Quarter Financial Results

- A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided below in the section titled “Reconciliation of Selected GAAP To Non-GAAP Results for Q3 2025.”

Fourth Quarter 2025 Financial Estimates

Archer’s financial estimates for fourth quarter of 2025 are as follows:

- Adjusted EBITDA to be a loss of $110 million to $140 million

We have not reconciled our Adjusted EBITDA estimates because certain items that impact non GAAP metrics are uncertain or out of our control and cannot be reasonably predicted. In particular, stock-based compensation expense and change in fair value of warrants is impacted by the future fair market value of our common stock and warrants along with other factors, all of which are difficult to predict, subject to frequent change, or not within our control. The actual amount of these expenses during 2025 will have a significant impact on our future GAAP financial results. Accordingly, a reconciliation of non-GAAP metrics is not available without unreasonable effort.

About Archer

Archer is designing and developing the key enabling technologies and aircraft necessary to power the future of aviation. To learn more, visit www.archer.com.

READ MORE ROTOR PRO: https://justhelicopters.com/Magazine

WATCH ROTOR PRO YOUTUBE CHANNEL: https://buff.ly/3Md0T3y

You can also find us on

Instagram - https://www.instagram.com/rotorpro1

Facebook - https://www.facebook.com/rotorpro1

Twitter - https://twitter.com/justhelicopters

LinkedIn - https://www.linkedin.com/company/rotorpro1