|

May

05

2025

|

|

Posted 301 days ago ago by Admin

|

|

On the personnel supply side of the equation, most every operator is working hard to recruit and retain experienced pilots.

There are still many external forces impacting the supply of working helicopter pilots. These forces are not only keeping the supply lines short of personnel, but stifling the growth of the base pilot pool as well.

As published in previous salary survey reports, the factors impacting operators stem from many issues to include; aging pilots retiring en-mass, aggressive airline recruitment of helicopter pilots, and the retraction of pilot training pipelines from traditional sources like civilian academies and the U.S. Military.

Tyler Carver, the director of operations of Papillon Helicopters (one of the largest tour operators) makes a smart observation that not only looks to new, prospective pilots, but their parents as well. He points out that some of the shortage of personnel in the helicopter aviation industry stems from competition with all aviation, airplanes included. “The new aviators are looking to universities for their education and with that comes high costs. Parents are often tapped to co-sign on a loan or pay the tuition expenses, which brings the question of ROI (return on investment). They look at the top end of pay from the major airlines and influence their soon-to-be aviators to go in that direction,” says Carver.

Operators from every sector are feeling the pinch, and the issue has garnered the attention of our industry’s trade organization, Vertical Aviation International (VAI).

“Workforce development is foundational to the future of vertical aviation. It is important enough that VAI has made it one of the association's 5 strategic initiatives,” says Bailey Wood, director of strategic communications with VAI.

The way VAI sees it, without a steady pipeline of skilled pilots, mechanics, and engineers, the industry simply cannot grow—or even sustain current operations. The shortages that industry is facing today are not theoretical; they’re impacting flight operations, maintenance schedules, and safety across the board. That’s why VAI formed a dedicated advisory council.

The VAI Workforce Industry Advisory Council (IAC) is tackling the pilot shortage head-on with practical, high-impact solutions. “We’re connecting talent to jobs through events like our industry-leading career fair and the Mil2Civ program, which helps military aviators transition to civilian roles. We’re also building the pipeline early with initiatives like the Utah Rotor Pathway in high schools and expanding awareness through events like the Fire Pilots Town Hall. These efforts, along with new professional development resources, have contributed to a 35% growth in student membership—showing real momentum in attracting and preparing the next generation of pilots,” says Wood.

What the Operators are Thinking

Rotor Pro asked several civilian operators to give us their take on the challenges of getting pilots into the industry at the entry level, as well as what types of creative solutions they have employed to fill vacant pilot positions.

At Helicopter Institute, a large training organization in the U.S, the company has seen the effects in both obvious and subtle ways. Fewer pilots mean increased demand for training, which is great for business on one hand — but it’s also created a bottleneck. Randy Rowles, president of Helicopter Institute indicated, “Clients want experienced pilots now, and many are struggling to find people who meet their standards. On our end, it means we have to work harder to not only train new pilots but help operators set realistic expectations about what today’s pilot pool looks like.”

Rowles points out that there’s no silver bullet and that part of the problem is the cost of becoming a helicopter pilot — it’s just flat-out expensive. So one big step forward would be better financial assistance, whether through scholarships, loans, or even partnerships with operators who are willing to invest in new talent.

As most companies, Helicopter Institute had to get creative by launching internal programs to grow talent from the ground up. This is done by investing in instructors who bring real-world operational experience — not just flight time — so they’re preparing people for the realities of the job, not just a checkride. “You can’t solve the pilot shortage by just throwing money at it. You solve it by investing in people — in their training, their time, and their future. That’s the bet we’ve made at Helicopter Institute,” says Rowles.

Mark Schlaefli, director of operations for Dakota Rotors, agrees with Rowles’ philosophy and believes that operators are going to have to participate in the solution in a big way. True pipelines need to be built to connect the industry’s employment tiers in a meaningful way. “We are taking a proactive approach, hiring the right candidates at lower hours and giving them the experience, not just the hours, needed to grow into other industry segments. We provide mentoring, not just a job,” says Schlaefli.

As most are aware, salaries are directly impacted by the size of the labor force. Typically in a shrinking pool of available pilots, salaries and benefits will rise across the board. This has been the case for the last several years according to the data.

In short, with the traditional training pipelines (military and civil) producing less helicopter pilots, combined with more working helicopter pilots leaving the industry all together, HR professionals, recruiters, and helicopter operators industry wide are attempting to work together on how to solve the issue.

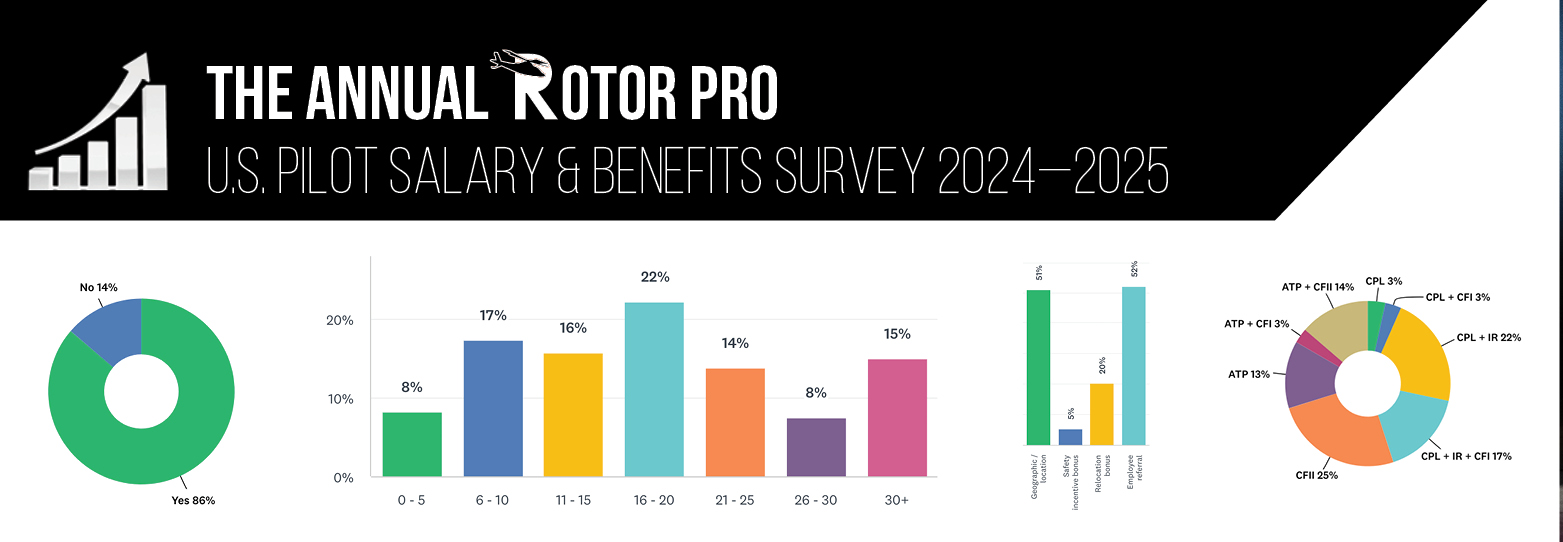

Insight: As noted in the graph, 77% of respondents answered “Yes” that the companies they fly for are short of pilots. It also appears that shortages are impacting working pilots personally. We asked pilots, “How are personnel shortages impacting you personally?” 23% checked the box that it was impacting them “Negatively: Fatigued and upsetting work / life balance.” On the other hand 34% indicated a “positive” impact as they were making more money in over-time. The remainder were unaffected or unsure.

2024-2025 Salary & Benefits Survey

Rotor Pro’s annual U.S. Pilot Salary & Benefits Survey was initially launched 11 years ago in an effort to monitor and report trends on the salaries of pilots in the industry. Thanks to online survey apps, we have the ability to survey many working pilots and their employers, thus generating more participation throughout the industry. This year’s survey had excellent participation and obtained the latest information on helicopter pilots:

⦿ What are their qualifications?

⦿ What do they fly?

⦿ In what sector do they fly?

⦿ What ratings do they have?

⦿ How much do they make?

⦿ What type of benefits do they receive?

We think you’ll find the answers to these questions revealing. The goal was for Rotor Pro to interact with our readers in the industry by focusing on two main questions:

⦿ How much do helicopter pilots earn while working in the U.S.?

⦿ Are helicopter pilots generally satisfied with their place in the industry?

The answer to the first question is fairly easy to gather; all it requires is collecting and analyzing data. However, the second question is more personal and subjective. In addition to comparative analysis, that answer also requires introspection. Both employers and pilots want to know where they stand in relation to their peers in the industry. We hope our results will help you find answers for your specific situation.

Who Took the Survey?

Hundreds of pilots took our survey and they came from many sectors of the industry, including air ambulance, offshore oil support, tours, utility/lifting, law enforcement, firefighting, ag/spraying, corporate (business & private owner), training, and multi-type flying.

Additionally pilots from virtually every type of position took the survey. The majority, 77% of respondents, came from the ranks of line pilots and lead pilots. The remaining 23% came from positions such as CFIs, check airmen, chief pilots, and directors of operations.

INSIGHT: 4% of respondents are U.S. pilots working as expats in overseas markets

Here’s the breakdown of survey respondents' experience. As you will see, the majority of the pool is very experienced.

Respondents by years in industry:

Respondents by flight-hours experience:

Respondents by ratings held:

Respondents by type aircraft flown:

Methodology

This survey was distributed widely through use of email, social media, websites, and our magazine. All pilots were encouraged to participate. An online third-party survey company was used as the medium for survey completion, data collection, and analytics. Some overall totals will not add to 100% due to rounding, and on some questions, the option to choose more than one answer.

As in any survey, there will be certain considerations and assumptions that must be made when analyzing and tabulating data. Some of our consideration and assumptions were:

⦿ This survey is designed to report 2024 data, which is the most recent full tax year.

⦿ We implemented the survey in early 2025 during the time when pilots were filing tax returns for 2024.

⦿ We assume that respondents are aware of their own compensation and benefits in enough detail to answer the survey questions accurately.

How to Read the Numbers

For any category of data, we try to consistently present three pieces of information:

-

Gross Salary Ranges: L = Low / M = Median / H = High

2. The numerical value range is in annual USD. Example: 60+-70K = $60,001 to $70,000 per year

3. The percent (%) of respondents in a category that make up the L, M, or H ranges

FOR EXAMPLE: L 60K+-70K (10%) means the low salary range in the category is $60,000 to $70,000 and 10% of respondents make up the low range in that category.

THE SURVEY RESULTS

BASE salary ranges in overall industry

GROSS salary ranges in overall industry

INSIGHT: In 2024, the largest percentage of pilots in the industry grossed between $110,000 to $200,000 per year, up 10% from 2023.

Differences Between Base and Gross Pay

It’s clear that overall gross and base pay have increased over the years for helicopter pilots. However, when you strip away the overtime and incentives, the base pay numbers are a bit lower across the industry. This is especially true in the sector of helicopter air ambulance (HAA), where four-pilot bases may be short staffed, and pilots regularly work overtime shifts. For example, specifically in HAA, 82% of the pilots earned an extra $9,000 to $20,000+ in overtime and incentives. Of that 82%, 48% earned more than $20,000!

EXTRA PAY (overtime, bonus, incentives) earned above base pay in overall industry

INSIGHT: Anecdotally, although it appears that overall gross pay has been rising for helicopter pilots, for a majority of them, their pay is not growing from raises in base salary alone, but often from working more hours in the form of overtime.

Show Me the Salary

Speaking of more money, it should be no surprise that helicopter pilots are attracted to the idea of bigger paychecks and better retirement plans. In every single salary and benefits survey we have conducted since 2014, when asked the question: “As an employee of a helicopter operator, which attributes of the job are MOST IMPORTANT to you?” By a large margin the top answer is always salary. In this survey it was no different with 86% of respondents choosing salary as being most important to them.

The difference between the past and now is that in the past helicopter pilots really had nowhere to go to earn higher salaries than what was being offered in the industry. That has changed.

So, the next theoretical questions that should be asked are: Can the helicopter industry generally compete against the airlines with respect to pay? If not, given the current supply situation, could the growth of the industry as a whole be stunted due to a shortage of helicopter pilots? If so, the question still remains, what can the industry actually do about it?

Gross salary ranges by position

|

Position

|

Low

|

Median

|

High

|

|

Instructor Pilots

|

<50K (37%)

|

110-130K (16%)

|

>200K (5%)

|

|

Line Pilots

|

<50K (1%)

|

100-110K (11%)

|

>200K (7%)

|

|

Lead Pilots

|

90-100K (1%)

|

130-150K (21%)

|

>200K (21%)

|

|

Chief Pilots

|

100-110K (4%)

|

150-175K (23%)

|

>200K (31%)

|

|

Training/Check Airman

|

90-100K (5%)

|

130-150K (15%)

|

>200K (18%)

|

|

Director of Ops

|

110-130K (18%)

|

150-175K (9%)

|

>200K (36%)

|

Salary ranges by certificate/ratings

Pilots who hold an ATP not only have a $20,000 to $30,000 per year higher gross median salary than those who do not, but a larger percentage of them make up the higher income brackets. Three factors may influence the higher earnings for ATP certificate holders:

1) Many employers pay an ATP bonus.

2) Higher paying jobs generally require an ATP as a prerequisite to being hired.

3) Pilots may have more tenure as a working pilot prior to obtaining the ATP.

Gross salary ranges by sector

|

Sector

|

Low

|

Median

|

High

|

|

Training

|

<50K (30%)

|

110-130K (22%)

|

>200K (4%)

|

|

Tours

|

<50K (18%)

|

100-110K (9%)

|

>200K (9%)

|

|

Multi-type flying

|

60-70K (8%)

|

130-150K (15%)

|

>200K (31%)

|

|

Ag/spraying

|

70-80K (25%)

|

130-150K (25%)

|

>200K (25%)

|

|

Helicopter air ambulance

|

80-90K (3%)

|

110-130K (28%)

|

>200K (6%)

|

|

Law enforcement

|

60-70K (6%)

|

110-130K (44%)

|

>200K (11%)

|

|

Firefighting

|

70-80K (8%)

|

110-130K (23%)

|

>200K (8%)

|

|

Utility/lifting

|

60-70K (9%)

|

110-130K(21%)

|

>200K (9%)

|

|

Offshore oil support

|

70-80K (6%)

|

130-150K (19%)

|

>200K (19%)

|

|

Corporate

|

<50K (10%)

|

130-150K (30%)

|

>200K (60%)

|

INSIGHT: If you want the best chance of reaching a salary of $200,000 or higher as a helicopter pilot, your best opportunities are in the sectors of offshore oil support, ag/spraying, multi-mission ops, and corporate flying.

Gross salary ranges by years experience working as helicopter pilot

|

Years

|

Low

|

Median

|

High

|

|

0 - 5 Years

|

<50K (28%)

|

80-90K (10%)

|

150-175K (5%)

|

|

6 - 10 Years

|

60-70K (7%)

|

110-130K (40%)

|

>200K (5%)

|

|

11 - 15 Years

|

70-80K (4%)

|

110-130K (33%)

|

>200K (7%)

|

|

16 - 20 Years

|

80-90K (10%)

|

110-130K (20%)

|

>200K (12%)

|

|

21 - 25 Years

|

90-100K (16%)

|

130-150K (18%)

|

>200K (13%)

|

|

26 - 30 Years

|

90-100K (5%)

|

130-150K (15%)

|

>200K (25%)

|

|

30+ Years

|

90-100K (3%)

|

130-150K (23%)

|

>200K (24%)

|

INSIGHT: When it comes to single- vs. multi-engine helicopters, the sooner you can get into multi-engines, the sooner you’ll make more money. Only 14% of all single-engine pilots reached the top salary ranges, compared to 30% of their multi-engine pilot counterparts.

Extra Pay and Extra Hours

It’s a mixed bag when it comes to pay raises, bonus/incentive pay, and compensation for extra work hours. A large portion of our industry (63%) still received no pay raise or a pay raise of less than 3%. However, that number is 9 percentage points below the 2021 number of 72%. In other words, more pilots received pay raises in 2024 compared to three years before. This is likely due to operators focusing more on pilot retention.

The main factor for earning extra pay is overtime. The largest segment of pilots (50%) are paid overtime at 1.5 times their normal rate, which is up from 47% just last year. It appears that operators are either increasing the extra work pay benefit or getting creative in their offerings. For example, not only did we have an uptick in extra pay to two times the normal rate, but many pilots were happy to accept “comp-time”, or time off, in exchange for working extra hours.

A full 17% either get no extra pay for working extra hours or do not work extra hours at all. Whereas 4% get paid straight-time for extra hours worked. The remaining respondents’ compensation for extra hours were based on a variety of formulas.

Question: What percent pay raise did you receive in 2024?

INSIGHT: VFR & IFR

-

Career pilots who fly only VFR are most likely relegated to pay of $100,000 to $150,000 per year.

-

Career pilots who fly both VFR and IFR will be compensated much more. The pay for the largest group of these pilots fell in the range of $150,000 to $200,000.

Question: What types of incentive-bonus pay does your employer offer?

INSIGHT: MOONLIGHTING PILOTS

-

14% of pilots responded yes to the question, “Do you fly part-time (or as a contract pilot) to earn extra income outside of your full-time flying job?”

-

Of those moonlighting pilots, there was a broad range of income earned which ranged between $5k (15% of moonlighters) to over $30k (29% of moonlighters.)

Retirement Benefits

Helicopter operators have come a long way in the last decade in the area of retirement. According to 93% of respondents, their employers offer some sort of retirement plan. Of those who offer plans, 86% of employers contribute to employee plans by either straight and/or matching contributions.

INSIGHT: The number of employers offering matching retirement funds has increased by 8% since the 2021 survey.

Question: How much does your employer contribute to your retirement plan?

Health Benefits

A full 97% of respondents have healthcare benefits. How the cost of benefits are divided up between the employer and the employee is mixed, with the majority of respondents having some portion paid for by the employer.

Question: How are you afforded health benefits?

Question: How many paid personal days off (vacation/sick) are you afforded annually? Do not include holidays.

Job Satisfaction – What Matters Most?

When it comes to job satisfaction, 70% (down from 2022) of respondents are generally happy with their jobs. However, nearly half of those respondents indicate that although they are happy, they are open to a better opportunity. The remainder indicate that they are happy, but plan on staying put for at least three years.

The other 30% indicate that they are unhappy in their current job, with 14% of those indicating that they are “seriously considering moving to the airlines.”

INSIGHT: What pilots want, love, and hate the most . . .

-

Top 3 WANTS: higher salary, desirable location, and better safety culture

-

Top 3 LIKES: location, salary, and ability to take time off

-

Top 3 DISLIKES: salary, management, and ability to take time off

Question: As an employee of a helicopter operator, which attributes of the job are MOST IMPORTANT to you? (choose 3)

Summing Up

So there you have it; that’s Rotor Pro’s current Annual U.S. Pilot Salary & Benefits Survey. If one can read between the lines, there might be a few key takeaways and questions for operators, HR directors, and recruiters to consider given the seriousness of the situation:

-

There is a shortage of experienced helicopter pilots. It’s critical in some sectors such as air ambulance.

-

The traditional supply chains for pilots (military and civilian) are shrinking, not expanding.

-

Where there were no real opportunities before for helicopter pilots to earn higher pay and benefits as compared to the airlines, there are options today and many helicopter pilots are exercising those options.

-

Helicopter pilot job satisfaction has decreased significantly. In our 2015-2016 survey, 86% were happy and only 14% were unhappy. In this survey, only 70% are happy and a full 30% are unhappy and seeking other opportunities.

-

Will industry collaboration through the Vertical Aviation International’s Workforce Industry Advisory Council create solutions that net results? Or will only time do that?

Now, we welcome your feedback. Please let us know what you think. Until next year: Fly safe. Be safe.

READ MORE ROTOR PRO: https://justhelicopters.com/Magazine

WATCH ROTOR PRO YOUTUBE CHANNEL: https://buff.ly/3Md0T3y

You can also find us on

Instagram - https://www.instagram.com/rotorpro1

Facebook - https://www.facebook.com/rotorpro1

Twitter - https://twitter.com/justhelicopters

LinkedIn - https://www.linkedin.com/company/rotorpro1