|

May

06

2024

|

|

Posted 1 years 291 days ago ago by Admin

|

|

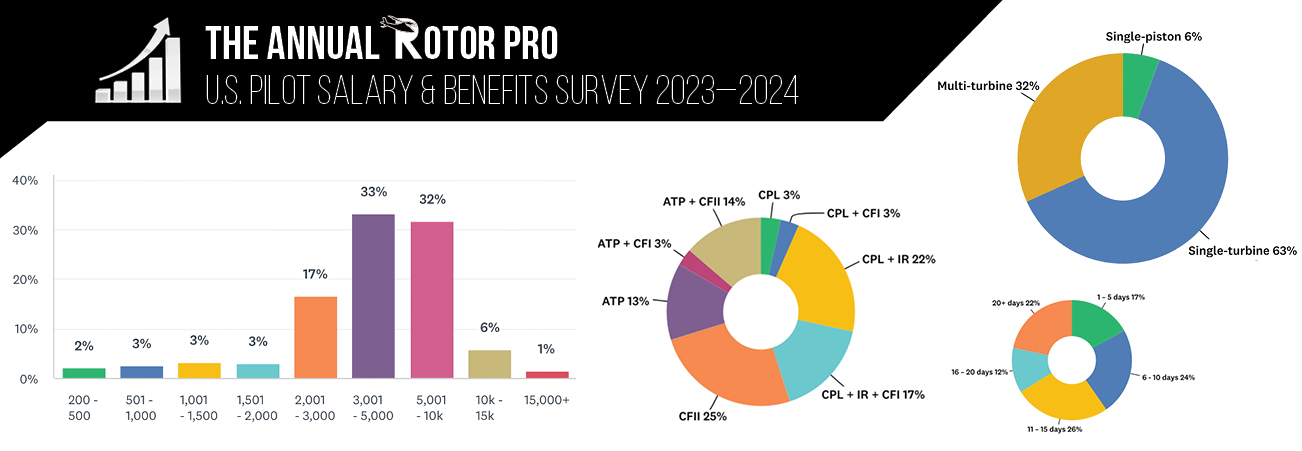

THE 2023—2024 ANNUAL ROTOR PRO U.S. PILOT SALARY & BENEFITS SURVEY

On the personnel supply side of the equation, things seem to be getting slightly better, but not much!

There are still many external forces impacting the supply of working helicopter pilots. These forces are not only keeping the supply lines short of personnel, but stifling the growth of the base pilot pool as well.

As published in previous salary survey reports, the factors impacting operators stem from many issues to include; aging pilots retiring en-mass, aggressive airline recruitment of helicopter pilots, and the retraction of pilot training pipelines from traditional sources like civilian academies and the U.S. Military.

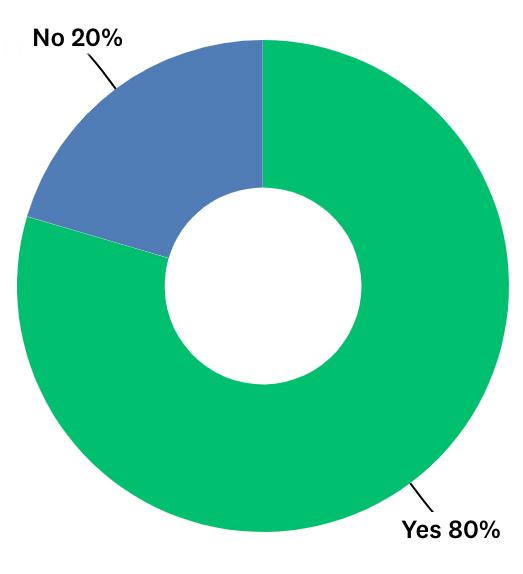

Insight: As noted in the graph, 80% of respondents answered “Yes” that the companies they fly for are short of pilots. It also appears that shortages are impacting working pilots personally. We asked pilots, “How are personnel shortages impacting you personally?” 25% checked the box that it was impacting them “Negatively: Fatigued and upsetting work / life balance.” On the other hand 32% indicated a “positive” impact as they were making more money in over-time. The remainder were unaffected or unsure.

Don’t just take it from us, operators from every sector are feeling the pinch, and the issue has garnered the attention of our industry’s trade organization, Vertical Aviation International (VAI).

“Currently, there are few bigger industry issues than the demand for qualified pilots, engineers, and maintenance technicians. That's why workforce development is a part of VAI’s strategic plan and the focus of a dedicated working group,” says Bailey Wood, director of strategic communications with VAI.

According to VAI, the Workforce Development Working Group was established two years ago to bring together representatives from across the industry and create programs that develop the workforce for both present and future needs. The Working Group is developing a pathway to guide the industry in recruiting and retaining the next generation of workers. Additionally, they are expanding the state-based Rotor Pathway Program, creating a seamless journey from high school through professional licensing to internships and mentoring opportunities as well as boosting professional ranks through the MIL2CIV program that seeks to help service members transition from military to civilian life. “From outreach to maintenance technician schools to mentorship programs, VAI is committed to growing the next generation of industry professionals,” says Wood.

Cultural - Generational Attitude Shift?

Rotor Pro asked several civilian flight training organizations to give us their take on the challenges of getting pilots into the industry at the entry-level, and what types of creative solutions they have employed to find the next generation of pilots.

One interesting observation from Alex Chaunt, owner of Anthelion Helicopters is that there seems to be a shift in attitude of pilot applicants at the entry level. “The general attitude of applicants is not what it used to be. In the past, people have wanted to prove themselves, to demonstrate a strong work ethic, learn the job, and be the best they can be. Nowadays, it's more about what you can do for them straight away, how much time off they get, and what benefits there are,” says Chaunt. We’re not sure if this attitude is a generational change or more related to pilot candidates perceiving they have more bargaining power. Perhaps it’s a little of both.

Regardless, schools like Anthelion have had to not only change the pilot pay structure, but also the hourly amount as well as create promotional opportunities and offer new benefits like 401K matching. The downside is that it’s a very slippery slope with respect to profitability. “Overall, it is very challenging to do all of this in the context of budgets. The reality is we cannot charge what we really need to. To achieve a sustainable model for basic flight training, to pay and attract good instructors when faced with the existential threat of the airlines, and with margins that can accommodate inflation in all areas, we really need to be $75 to $100 more an hour on flight training. If something does not change soon I fear many smaller operators will simply not want to or be able to stay in business with the slim to non-existent margins,” says Chaunt.

As most are aware, salaries are directly impacted by the size of the labor force. Typically in a shrinking pool of available pilots, salaries and benefits will rise across the board. This has been the case for the last several years according to the data.

In short, with the traditional training pipelines (military and civil) producing less helicopter pilots, combined with more working helicopter pilots leaving the industry all together, HR professionals, recruiters, and helicopter operators industry wide are attempting to work together on how to solve the issue.

2023-2024 Salary & Benefits Survey

Rotor Pro’s annual U.S. Pilot Salary & Benefits Survey was initially launched 10 years ago in an effort to monitor and report trends on the salaries of pilots in the industry. Traditionally, surveys were sent directly to employers via snail-mail in ballot form, then collected and tabulated. This old method did provide interesting results, but because employers are reluctant to reveal the exact salaries and benefits they provide, the sampling could be rather small and probably wasn’t always representative of the larger whole.

Thanks to online survey apps, we have the ability to survey many working pilots and their employers, thus generating more participation throughout the industry. This year’s survey had excellent participation and obtained the latest information on helicopter pilots:

⦿ What are their qualifications?

⦿ What do they fly?

⦿ In what sector do they fly?

⦿ What ratings do they have?

⦿ How much do they make?

⦿ What type of benefits do they receive?

We think you’ll find the answers to these questions revealing. The goal was for Rotor Pro to interact with our readers in the industry by focusing on two main questions:

⦿ How much do helicopter pilots earn while working in the U.S.?

⦿ Are helicopter pilots generally satisfied with their place in the industry?

The answer to the first question is fairly easy to gather; all it requires is collecting and analyzing data. However, the second question is more personal and subjective. In addition to comparative analysis, that answer also requires introspection. Both employers and pilots want to know where they stand in relation to their peers in the industry. We hope our results will help you find answers for your specific situation.

Who Took the Survey?

Hundreds of pilots took our survey and they came from many sectors of the industry, including air ambulance, offshore oil support, tours, utility/lifting, law enforcement, firefighting, ag/spraying, corporate (business & private owner), training, and multi-type flying.

Additionally pilots from virtually every type of position took the survey. The majority, 65% of respondents, came from the ranks of line pilots and lead pilots. The remaining 35% came from positions such as CFIs, check airmen, chief pilots, and directors of operations.

INSIGHT: 2.4% of respondents are U.S. pilots working as expats in overseas markets

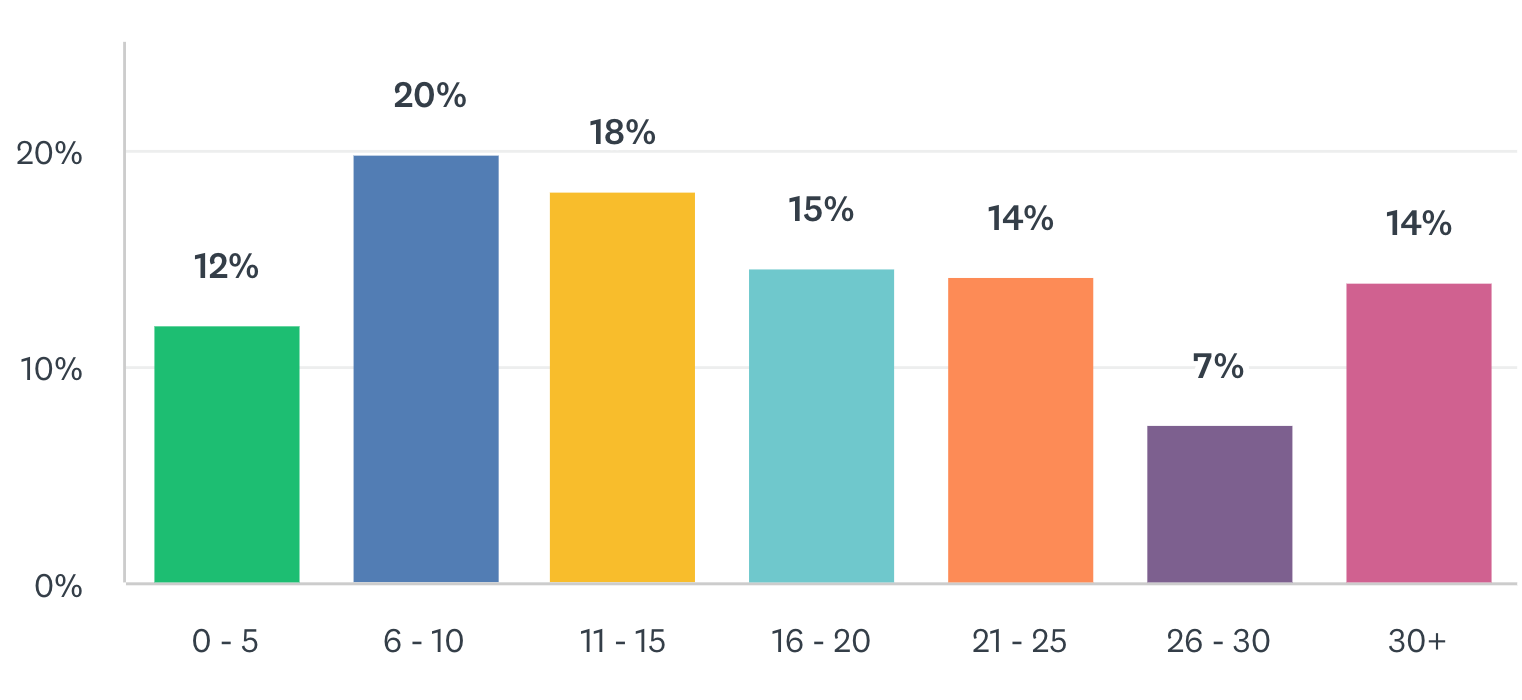

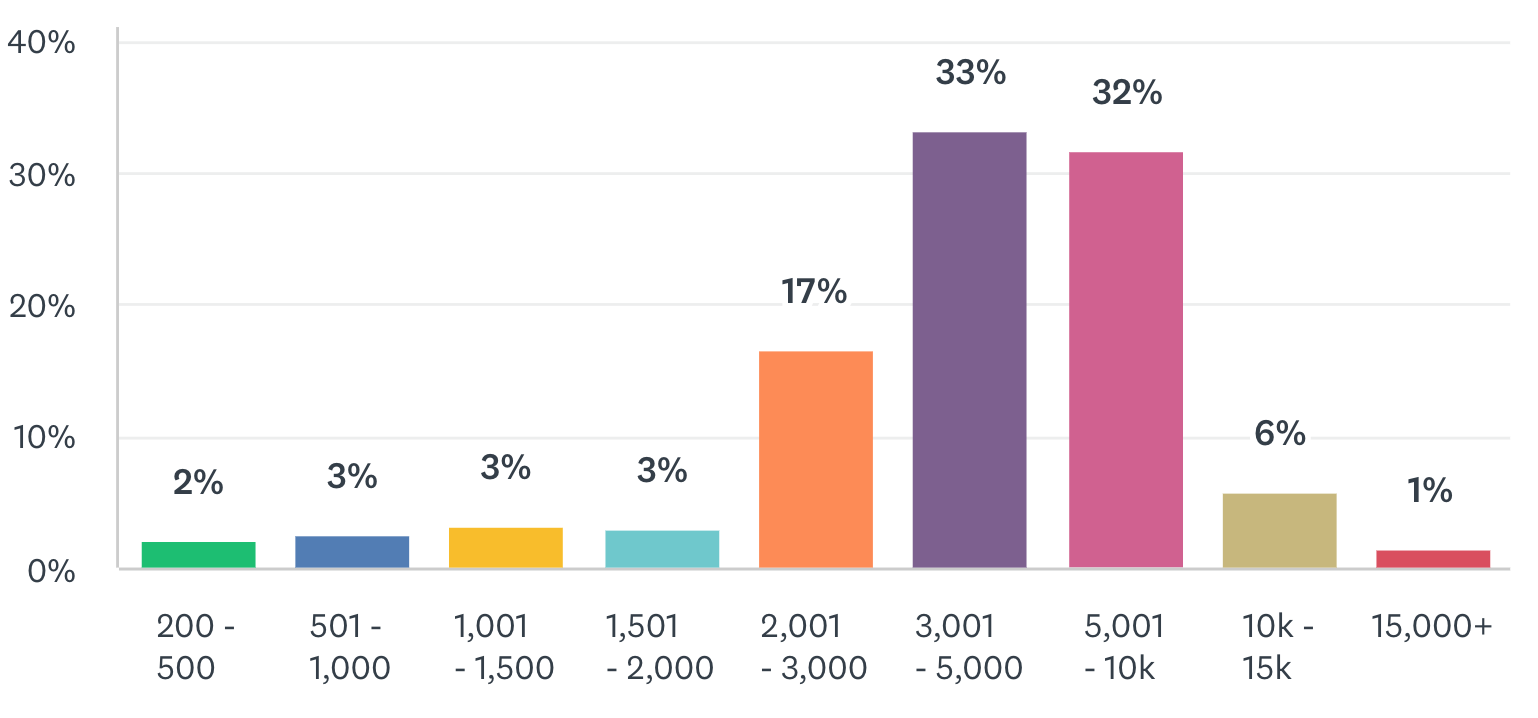

Here’s the breakdown of survey respondents' experience. As you will see, the majority of the pool is very experienced.

Respondents by years in industry:

Respondents by flight-hours experience:

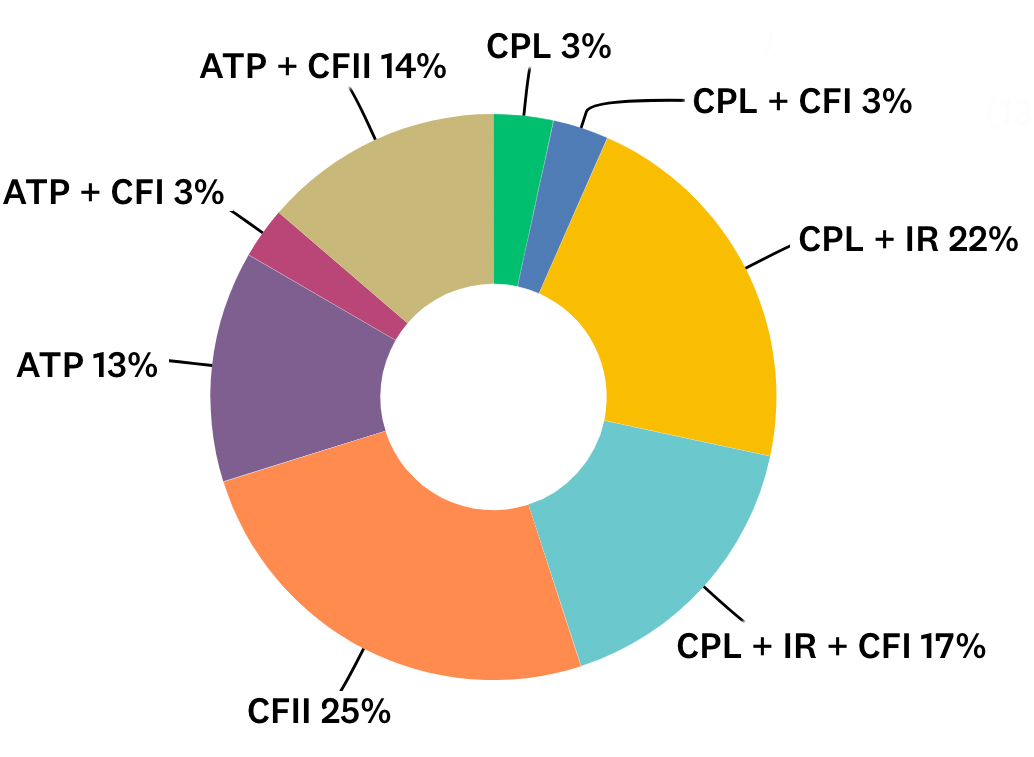

Respondents by ratings held:

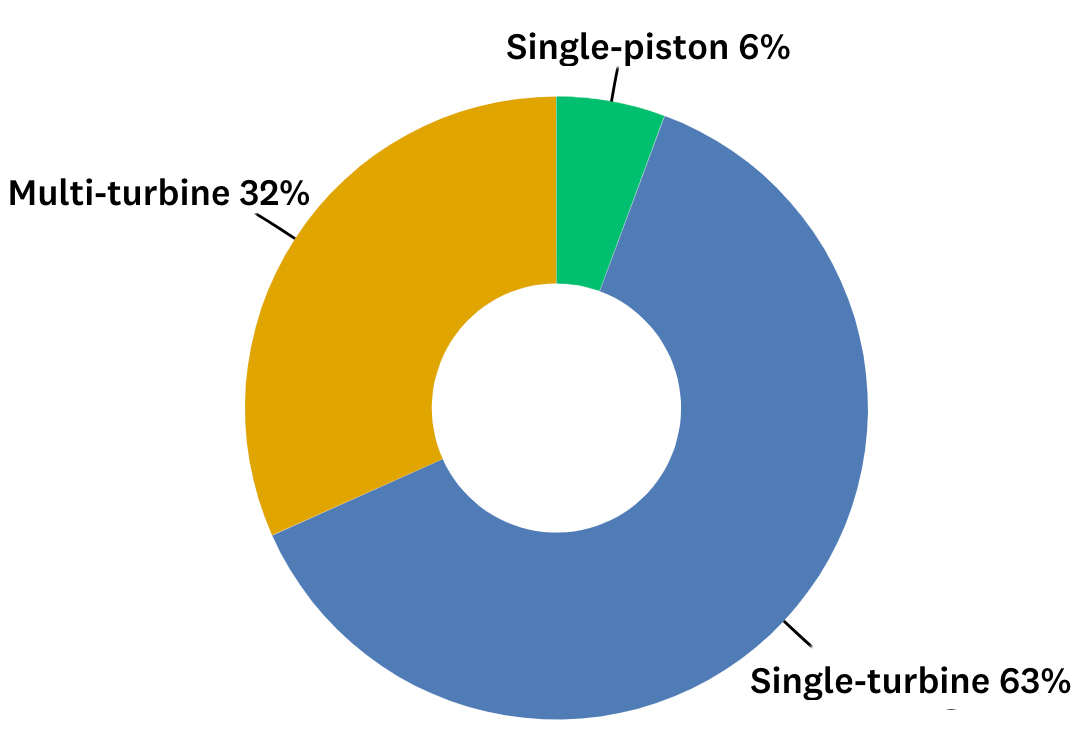

Respondents by type aircraft flown:

Methodology

This survey was distributed widely through use of email, social media, websites, and our magazine. All pilots were encouraged to participate. An online third-party survey company was used as the medium for survey completion, data collection, and analytics.

As in any survey, there will be certain considerations and assumptions that must be made when analyzing and tabulating data. Some of our consideration and assumptions were:

⦿ This survey is designed to report 2023 data, which is the most recent full tax year.

⦿ We implemented the survey in early 2024 during the time when pilots were filing tax returns for 2023.

⦿ We assume that respondents are aware of their own compensation and benefits in enough detail to answer the survey questions accurately.

How to Read the Numbers

For any category of data, we try to consistently present three pieces of information:

-

Gross Salary Ranges: L = Low / M = Median / H = High

2. The numerical value range is in annual USD. Example: 60+-70K = $60,001 to $70,000 per year

3. The percent (%) of respondents in a category that make up the L, M, or H ranges

FOR EXAMPLE: L 60K+-70K (10%) means the low salary range in the category is $60,000 to $70,000 and 10% of respondents make up the low range in that category.

THE SURVEY RESULTS

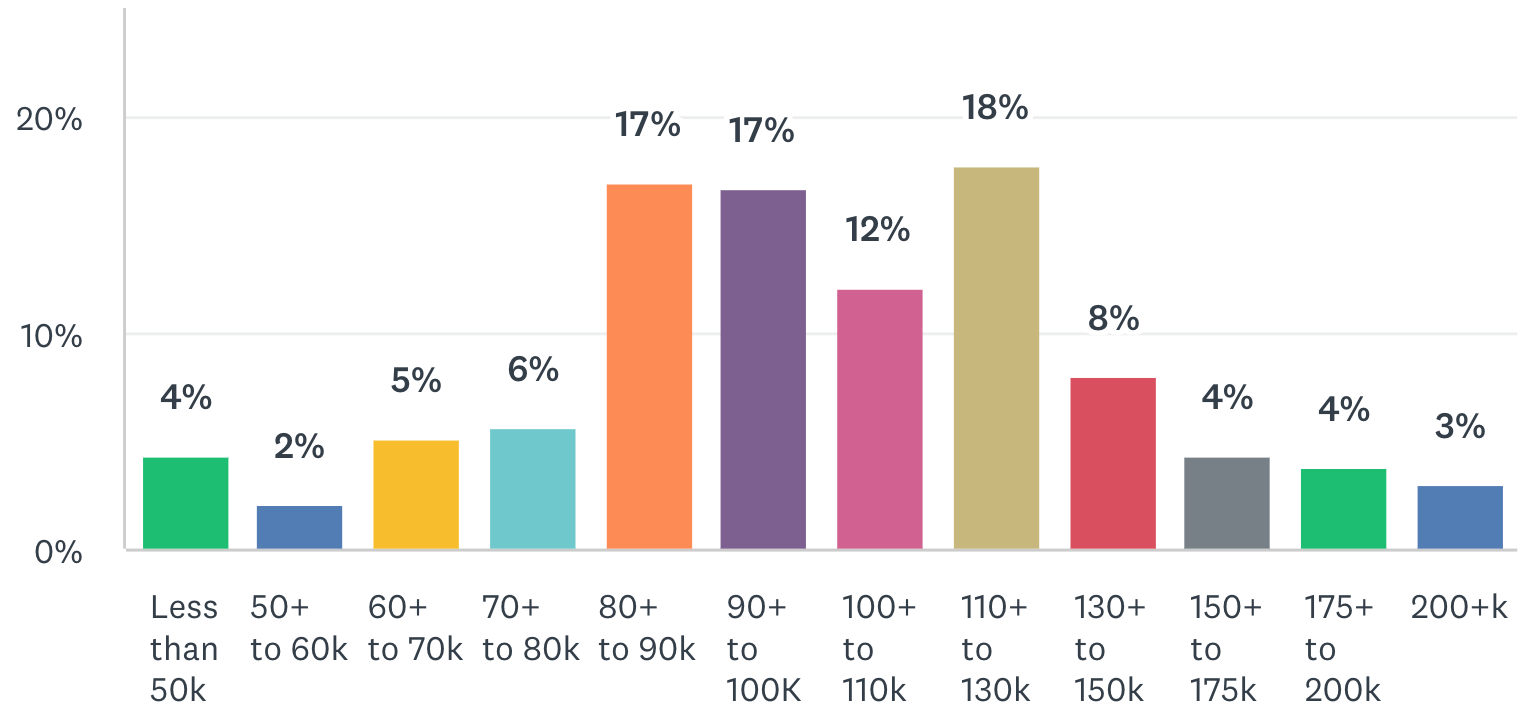

BASE salary ranges in overall industry

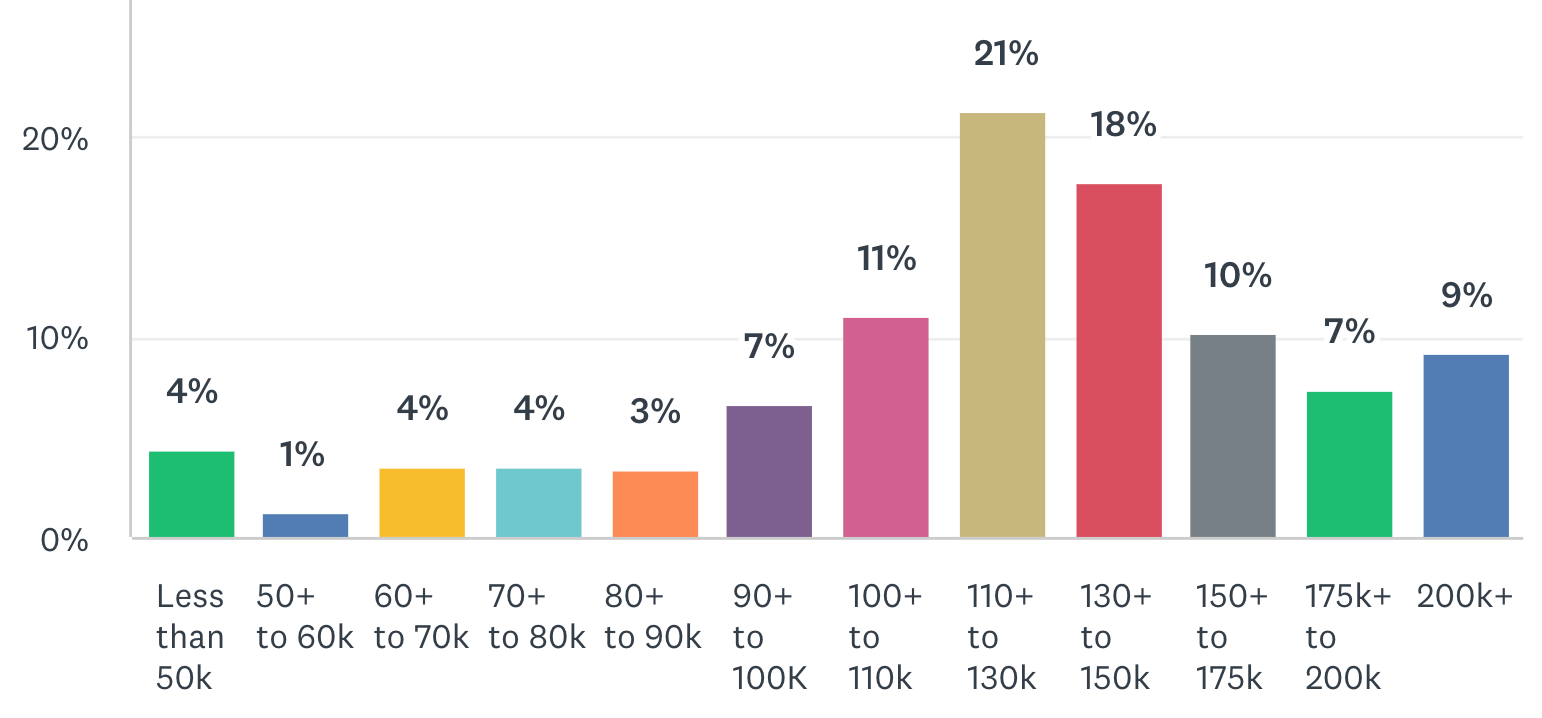

GROSS salary ranges in overall industry

INSIGHT: In 2023, the largest percentage of pilots in the industry grossed between $110,000 to $200,000 per year, up from 2022.

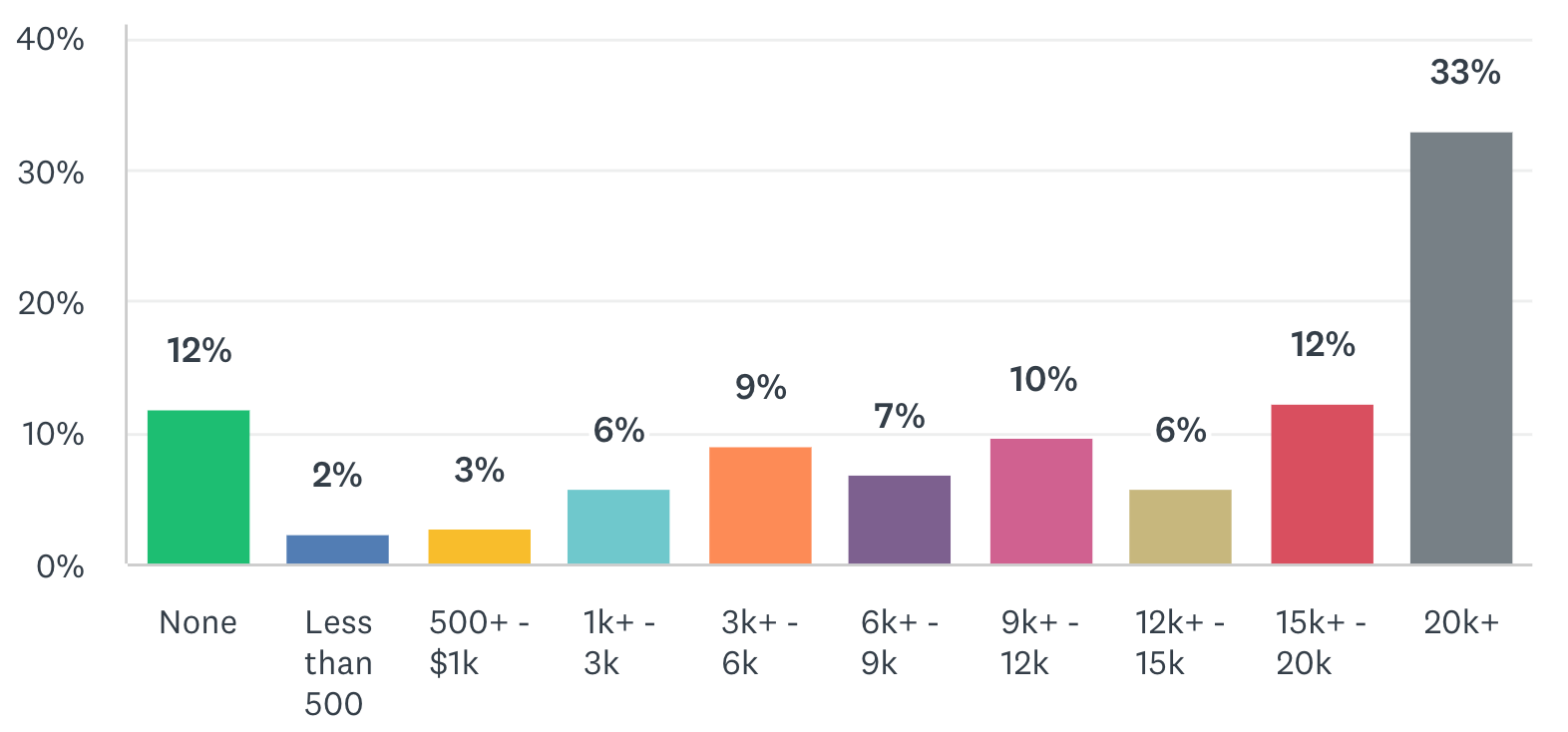

Differences Between Base and Gross Pay

It’s clear that overall gross and base pay have increased over the years for helicopter pilots. However, when you strip away the overtime and incentives, the base pay numbers are a bit lower across the industry. This is especially true in the sector of helicopter air ambulance (HAA), where four-pilot bases may be short staffed, and pilots regularly work overtime shifts. For example, specifically in HAA, 75% of the pilots earned an extra $9,000 to $20,000 in overtime and incentives - a 40% increase over 2022. Of that 75%, 43% earned more than $20,000!

EXTRA PAY (overtime, bonus, incentives) earned above base pay in overall industry

INSIGHT: Anecdotally, although it appears that overall gross pay has been rising for helicopter pilots, for a majority of them, their pay is not growing from raises in base salary alone, but often from working more hours in the form of overtime.

Show Me the Salary

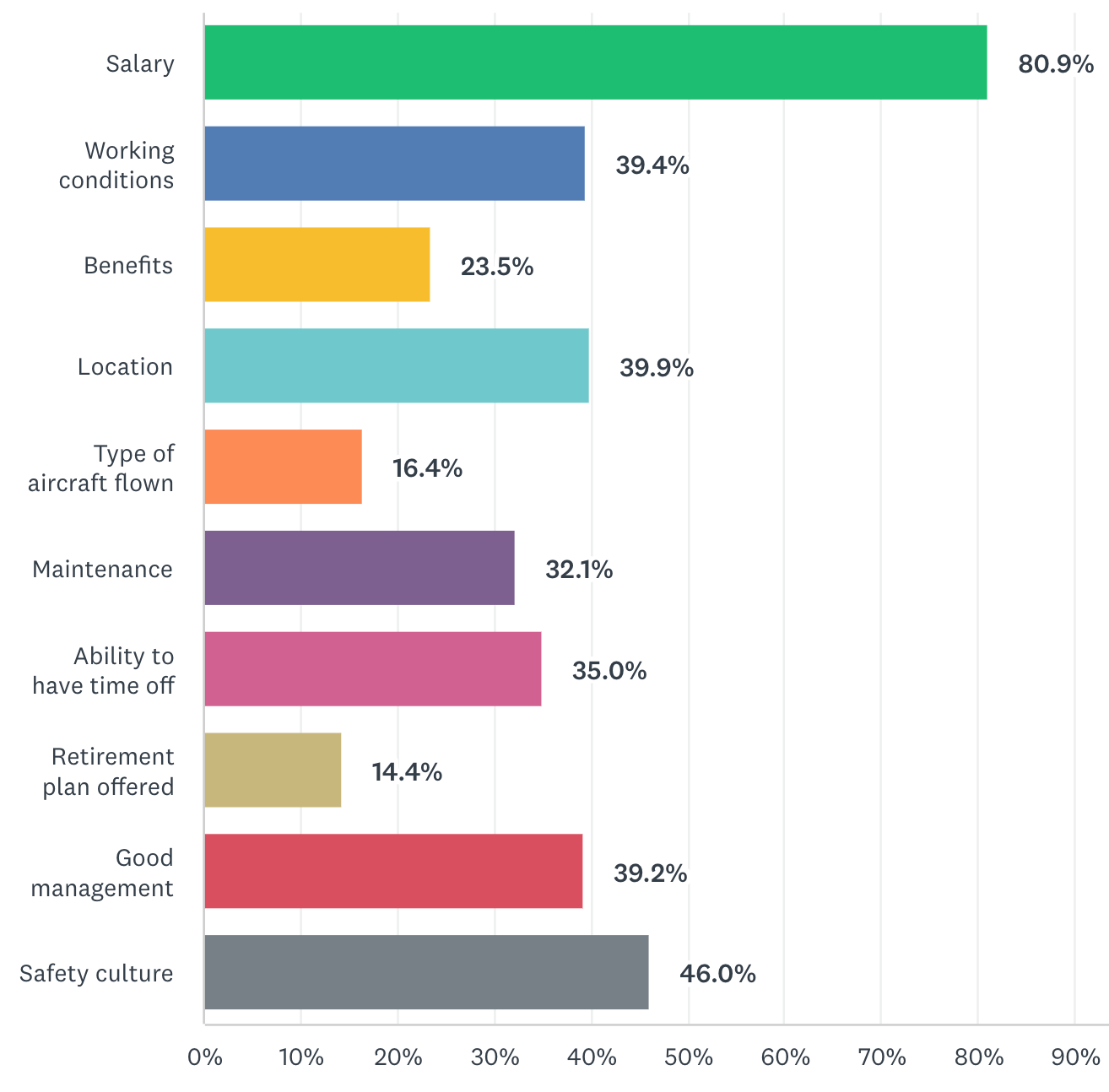

Speaking of more money, it should be no surprise that helicopter pilots are attracted to the idea of bigger paychecks and better retirement plans. In every single salary and benefits survey we have conducted since 2014, when asked the question: “As an employee of a helicopter operator, which attributes of the job are MOST IMPORTANT to you?” By a large margin the top answer is always salary. In this survey it was no different with 81% of respondents choosing salary as being most important to them.

The difference between the past and now is that in the past helicopter pilots really had nowhere to go to earn higher salaries than what was being offered in the industry. That has changed.

So, the next philosophical questions that should be asked are: Can the helicopter industry generally compete against the airlines with respect to pay? If not, given the current supply situation, could the growth of the industry as a whole be stunted due to a shortage of helicopter pilots? If so, the question still remains, what can the industry actually do about it?

Gross salary ranges by position

|

Position

|

Low

|

Median

|

High

|

|

Instructor Pilots

|

<50K (64%)

|

70-80K (7%)

|

110-130K (21%)

|

|

Line Pilots

|

<50K (3%)

|

100-110K (13%)

|

>200K (7%)

|

|

Lead Pilots

|

60-70K (5%)

|

110-130K (11%)

|

>200K (15%)

|

|

Chief Pilots

|

60-70K (5%)

|

110-130K (25%)

|

>200K (15%)

|

|

Training/Check Airman

|

90-100K (11%)

|

110-130K (22%)

|

175-200k (28%)

|

|

Director of Ops

|

90-100K (10%)

|

130-150K (10%)

|

>200K (30%)

|

Salary ranges by certificate/ratings

Pilots who hold an ATP not only have a $20,000 to $30,000 per year higher gross median salary than those who do not, but a larger percentage of them make up the higher income brackets. Three factors may influence the higher earnings for ATP certificate holders:

1) Many employers pay an ATP bonus.

2) Higher paying jobs generally require an ATP as a prerequisite to being hired.

3) Pilots may have more tenure as a working pilot prior to obtaining the ATP.

Gross salary ranges by sector

|

Sector

|

Low

|

Median

|

High

|

|

Training

|

<50K (60%)

|

70-80K (7%)

|

110-130K (20%)

|

|

Tours

|

<50K (17%)

|

70-80K (17%)

|

110-130K (17%)

|

|

Multi-type flying

|

60-70K (10%)

|

100-110K (20%)

|

>200K (20%)

|

|

Ag/spraying

|

<50K (17%)

|

70-80K (17%)

|

>200K (50%)

|

|

Helicopter air ambulance

|

80-90K (4%)

|

110-130K (27%)

|

>200K (5%)

|

|

Law enforcement

|

60-70K (12%)

|

110-130K (18%)

|

>200K (6%)

|

|

Firefighting

|

60-70K (4%)

|

110-130K (13%)

|

>200K (9%)

|

|

Utility/lifting

|

80-90K (6%)

|

130-150K (16%)

|

>200K (18%)

|

|

Offshore oil support

|

70-80K (12%)

|

110-130K (12%)

|

>200K (6%)

|

|

Corporate

|

60-70K (7%)

|

100-110K (7%)

|

>200K (36%)

|

INSIGHT: If you want the best chance of reaching a salary of $200,000 or higher as a helicopter pilot, your best opportunities are in the sectors of offshore oil support, utility/lifting, multi-mission ops, and corporate flying.

Gross salary ranges by flight hour experience

|

Total Hours

|

Low

|

Median

|

High

|

|

501 - 1000

|

<50K (63%)

|

50-60K (11%)

|

100-110K (21%)

|

|

1001 - 1500

|

<50K (15%)

|

80-90K (8%)

|

150-175K (8%)

|

|

1501 - 2000

|

50-60K (30%)

|

80-90K (10%)

|

100-110K (20%)

|

|

2001 - 3000

|

60-70K (5%)

|

100-110K (18%)

|

>200K (2%)

|

|

3001 - 5000

|

70-80K (4%)

|

110-130 (35%)

|

>200K (5%)

|

|

5001 - 10,000

|

100-110K (8%)

|

130-150K (20%)

|

>200K (20%)

|

|

10k+ - 15k

|

60-70K (8%)

|

110-130 (13%)

|

>200K (9%)

|

|

15,000+

|

90-110K (17%)

|

130-150K (17%)

|

>200K (17%)

|

Gross salary ranges by years experience working as helicopter pilot

|

Years

|

Low

|

Median

|

High

|

|

0 - 5 Years

|

<50K (31%)

|

80-90K (7%)

|

150-175K (2%)

|

|

6 - 10 Years

|

60-70K (6%)

|

100-110K 16%)

|

>200K (7%)

|

|

11 - 15 Years

|

70-80K (1%)

|

110-130K (23%)

|

>200K (11%)

|

|

16 - 20 Years

|

80-90K (4%)

|

110-130K (30%)

|

>200K (13%)

|

|

21 - 25 Years

|

90-100K (9%)

|

130-150K (16%)

|

>200K (16%)

|

|

26 - 30 Years

|

70-80K (6%)

|

110-130K (26%)

|

>200K (6%)

|

|

30+ Years

|

90-100K (4%)

|

130-150K (20%)

|

>200K (17%)

|

INSIGHT: When it comes to single- vs. multi-engine helicopters, the sooner you can get into multi-engines, the sooner you’ll make more money. Only 12% of all single-engine pilots reached the top salary ranges, compared to 24% of their multi-engine pilot counterparts.

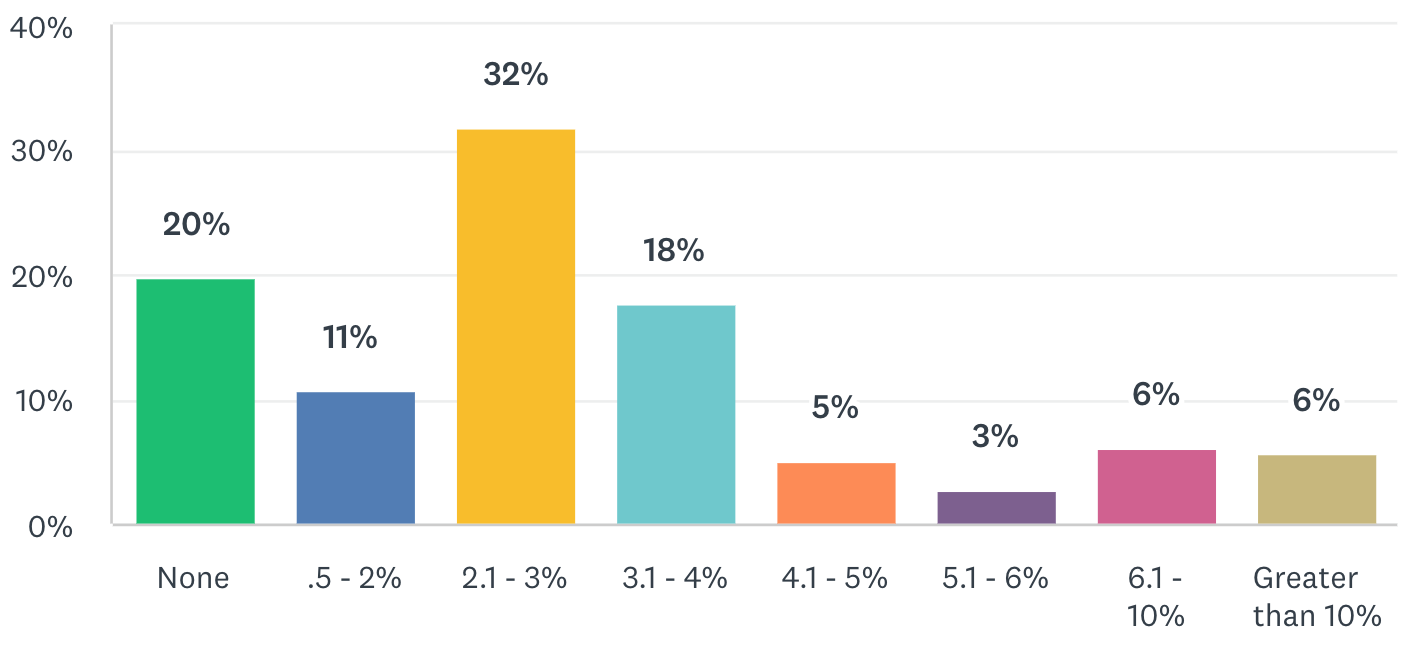

Extra Pay and Extra Hours

It’s a mixed bag when it comes to pay raises, bonus/incentive pay, and compensation for extra work hours. A large portion of our industry (63%) still received no pay raise, or a pay raise of less than 3%. However, that number is 9 percentage points below the 2021 number of 72%. In other words, more pilots received pay raises in 2023 compared to two years before. This is likely due to operators focusing more on pilot retention.

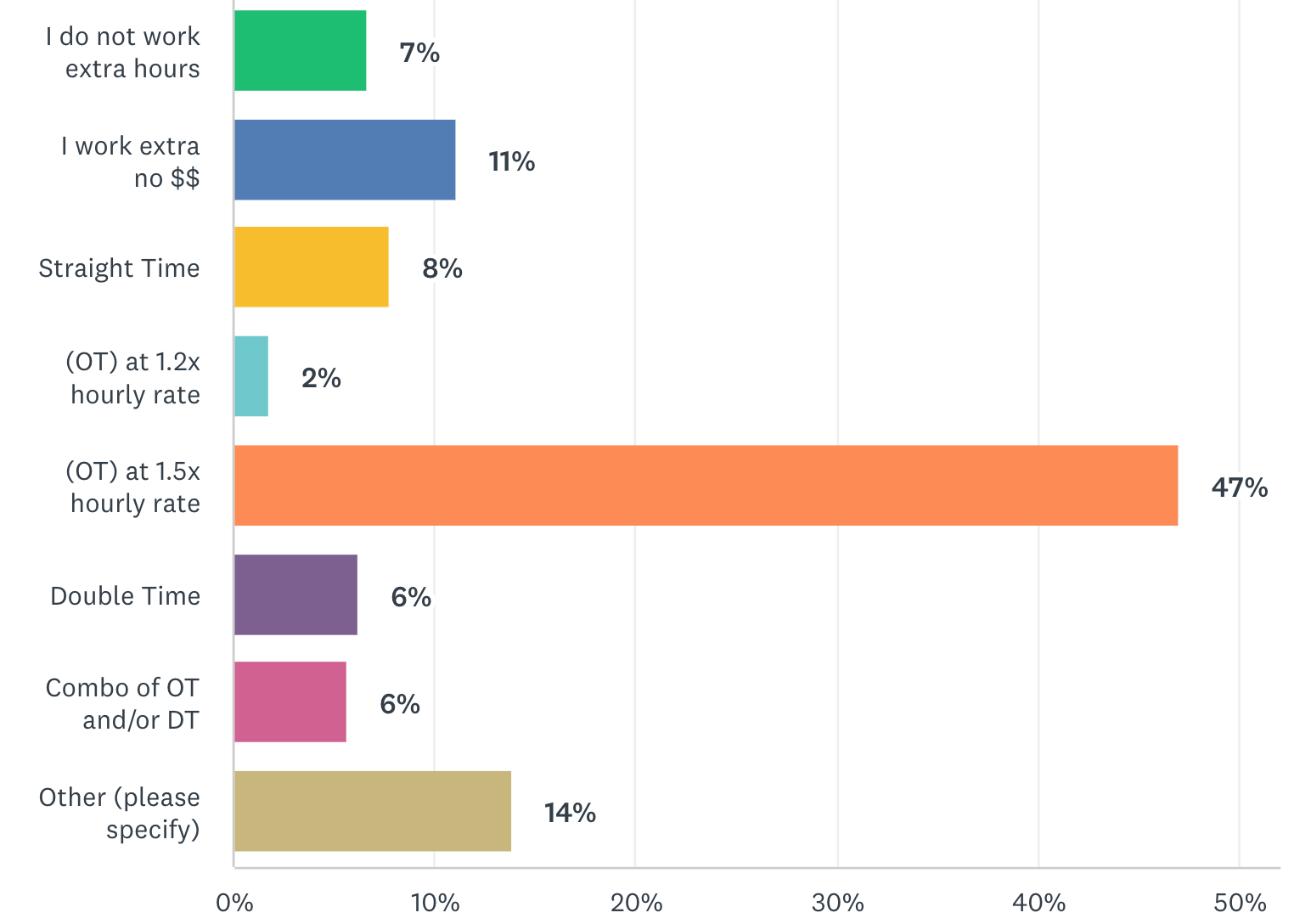

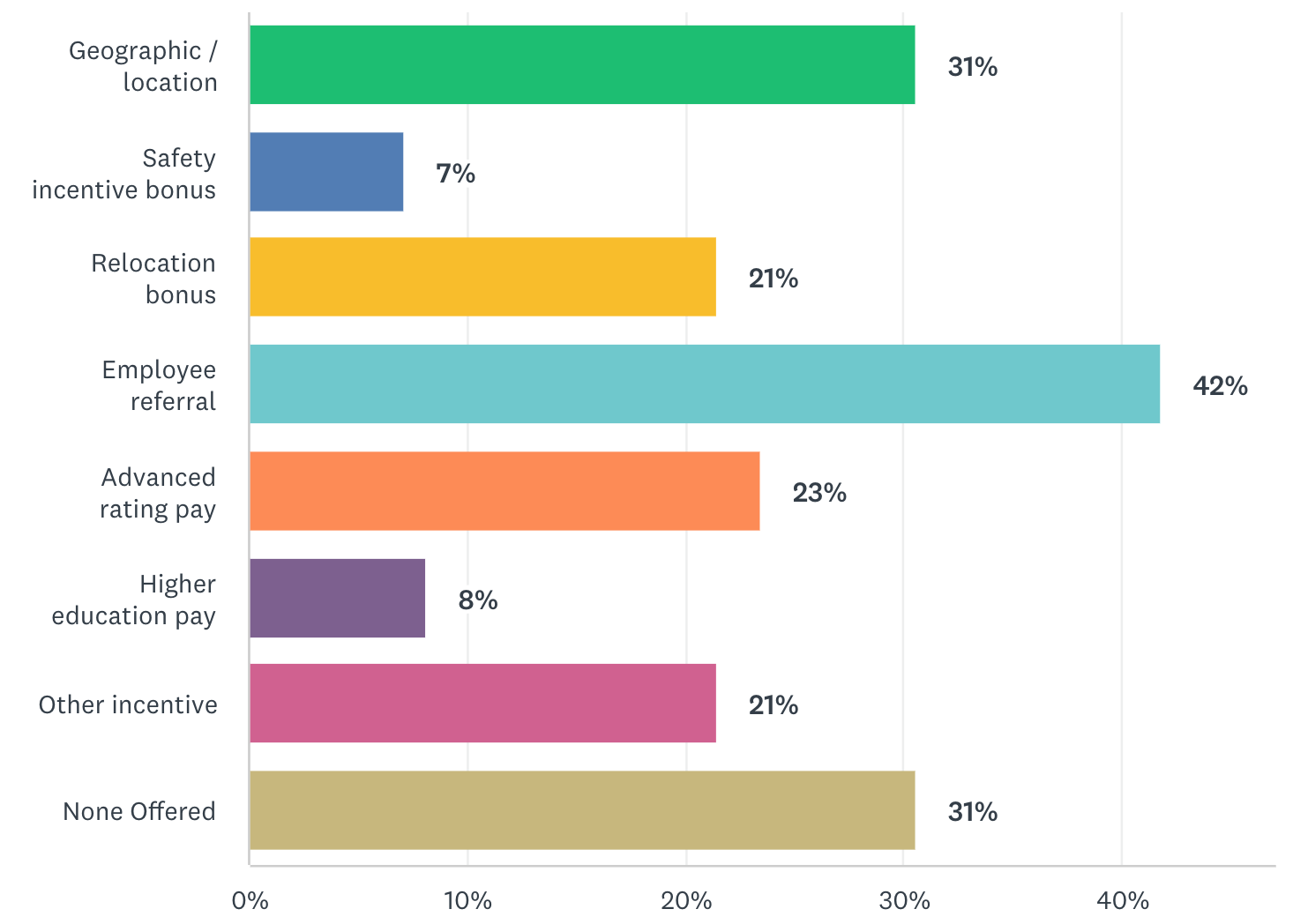

The main factor for earning extra pay is overtime. The largest majority of pilots (47%) are paid overtime at 1.5 times their normal rate, which is down from 62% just last year. This is an interesting reversal of a five-year trend. It appears that operators are either increasing the extra work pay benefit or getting creative in their offerings. For example, not only did we have an uptick in extra pay to two times the normal rate, but many pilots were happy to accept “comp-time”, or time off, in exchange for working extra hours.

A full 18% either get no extra pay for working extra hours or do not work extra hours at all. Whereas 8% get paid straight-time for extra hours worked. The remaining respondents’ compensation for extra hours were based on a variety of formulas.

Question: What percent pay raise did you receive in 2023?

Question: How are you compensated when you work extra hours or shifts?

INSIGHT: VFR & IFR

-

Career pilots who fly only VFR are most likely relegated to pay of $80,000 to $130,000 per year.

-

Career pilots who fly both VFR and IFR will be compensated much more. The pay for the largest group of these pilots fell in the range of $110,000 to $200,000.

Question: What types of incentive-bonus pay does your employer offer?

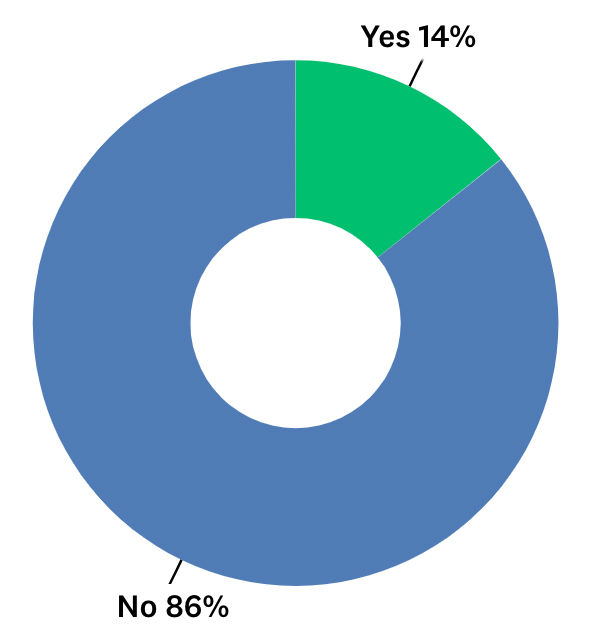

INSIGHT: MOONLIGHTING PILOTS

-

14% of pilots responded yes to the question, “Do you fly part-time (or as a contract pilot) to earn extra income outside of your full-time flying job?”

-

Of those moonlighting pilots, there was a broad range of income earned which ranged between $5k (18% of moonlighters) to over $30k (8% of moonlighters.)

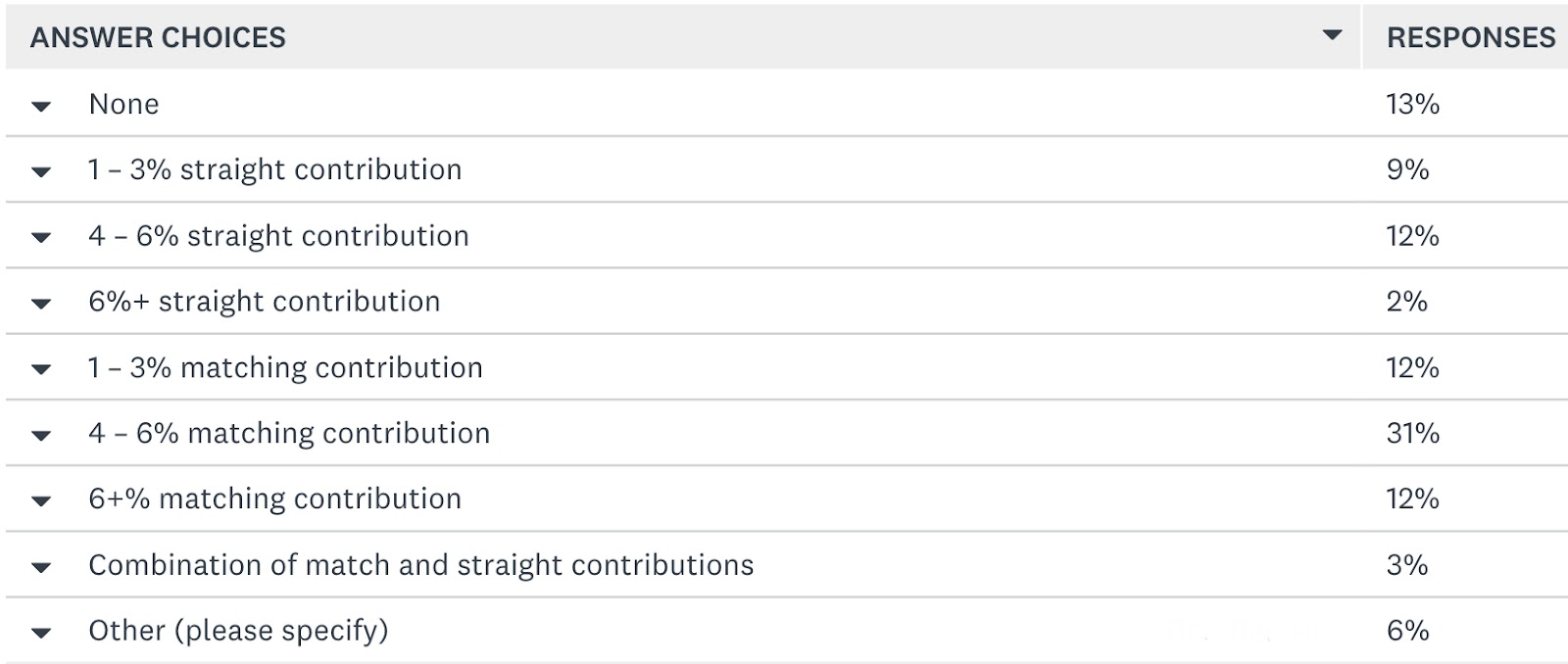

Retirement Benefits

Helicopter operators have come a long way in the last decade in the area of retirement. According to 91% of respondents, their employers offer some sort of retirement plan. Of those who offer plans, 87% of employers contribute to employee plans by either straight and/or matching contributions.

INSIGHT: The number of employers offering matching retirement funds has increased by 7% since the 2021 survey.

Question: How much does your employer contribute to your retirement plan?

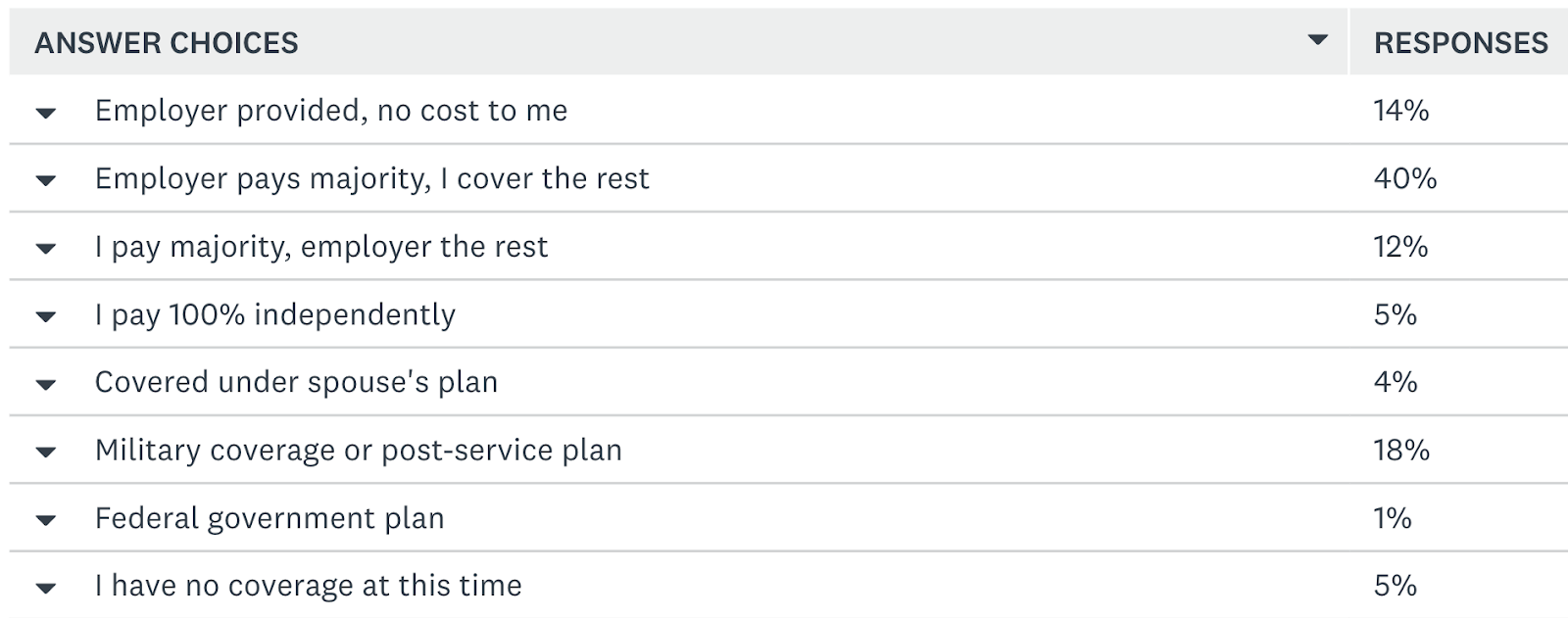

Health Benefits

A full 91% of respondents have healthcare benefits. How the cost of benefits are divided up between the employer and the employee is a mixed variation, with the majority of respondents having some portion paid for by the employer.

Question: How are you afforded health benefits?

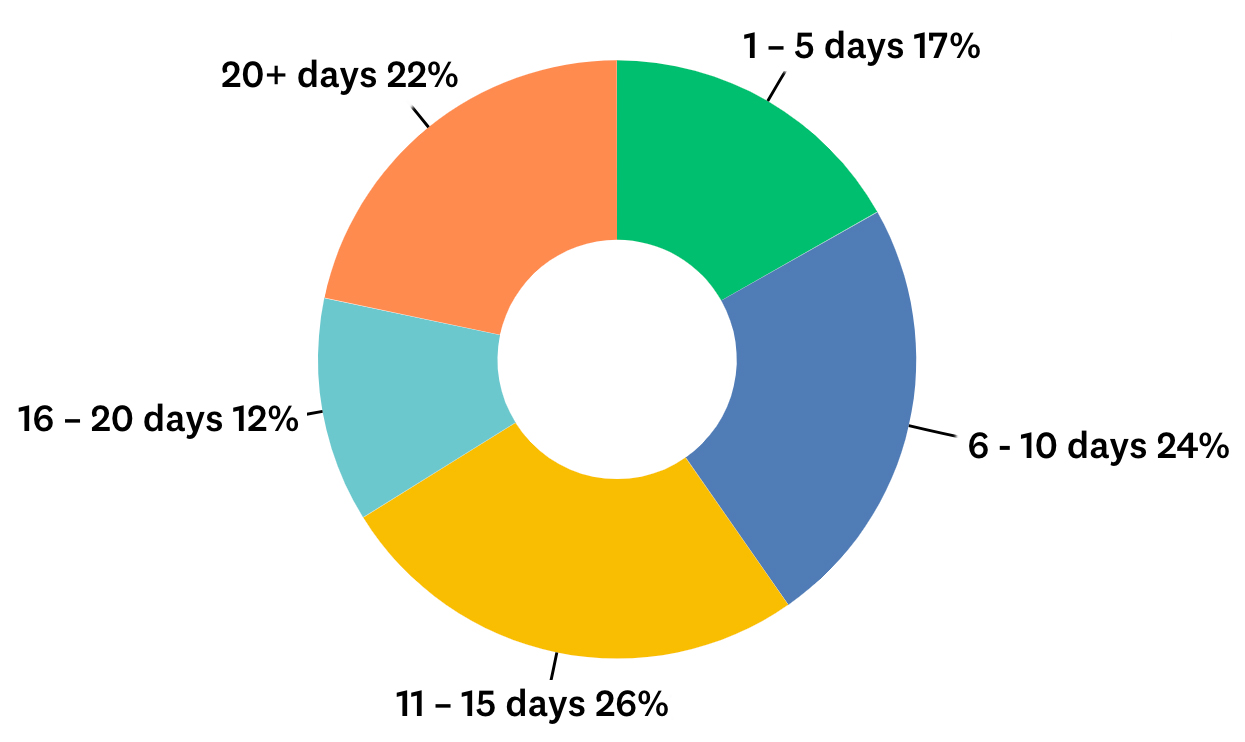

Question: How many paid personal days off (vacation/sick) are you afforded annually? Do not include holidays.

Job Satisfaction – What Matters Most?

When it comes to job satisfaction, 68% (down from 2022) of respondents are generally happy with their jobs. However, half of those respondents indicate that although they are happy, they are open to a better opportunity. The remainder indicate that they are happy, but plan on staying put for at least three years.

The other 32% indicate that they are unhappy in their current job, with 14% of those indicating that they are “seriously considering moving to the airlines.”

INSIGHT: What pilots want, love, and hate the most . . .

-

Top 3 WANTS: higher salary, desirable location, and better safety culture

-

Top 3 LIKES: location, salary, and safety culture

-

Top 3 DISLIKES: salary, management, and location

Question: As an employee of a helicopter operator, which attributes of the job are MOST IMPORTANT to you? (choose 3)

Summing Up

So there you have it; that’s Rotor Pro’s current Annual U.S. Pilot Salary & Benefits Survey. If one can read between the lines, there might be a few key takeaways and questions for operators, HR directors, and recruiters to consider given the seriousness of the situation:

-

There is a shortage of experienced helicopter pilots. It’s critical in some sectors such as air ambulance.

-

The traditional supply chains for pilots (military & civilian) are shrinking, not expanding.

-

Where there were no real opportunities before for helicopter pilots to earn higher pay & benefits as compared to the airlines, there are options today and many helicopter pilots are exercising those options.

-

Helicopter pilot job satisfaction has decreased significantly. In our 2015-2016 survey, 86% were happy and only 14% were unhappy. In this survey, only 68% are happy and a full 32% are unhappy and seeking other opportunities.

-

Will industry collaboration through the Vertical Aviation International’s Workforce Development Working Group create solutions that net results? Or will only time do that?

Now, we welcome your feedback. Please let us know what you think. Until next year, fly safe. Be safe.

READ MORE ROTOR PRO: https://justhelicopters.com/Magazine

WATCH ROTOR PRO YOUTUBE CHANNEL: https://buff.ly/3Md0T3y

You can also find us on

Instagram - https://www.instagram.com/rotorpro1

Facebook - https://www.facebook.com/rotorpro1

Twitter - https://twitter.com/justhelicopters

LinkedIn - https://www.linkedin.com/company/rotorpro1